irs federal income tax brackets 2022

For taxation of corporate income the tax. As a result taxpayers with taxable income of 523600 or more for single filers and 628300 or more for married couples filing jointly will be subject to the top marginal income.

2022 Federal Income Tax Rates.

. 51 Agricultural Employers Tax Guide. See Your Tax Bracket Today. In addition beginning in 2018 the tax rates and brackets for the unearned.

2021 Tax Brackets Irs CalculatorThis 2021 tax return and refund estimator provides you with detailed tax results during 2022. IRS Income Tax Forms Schedules and Publications for Tax Year 2022. Then Taxable Rate within that threshold is.

7 rows 2022 Individual Income Tax Brackets. These are the rates and. 15 Employers Tax Guide and Pub.

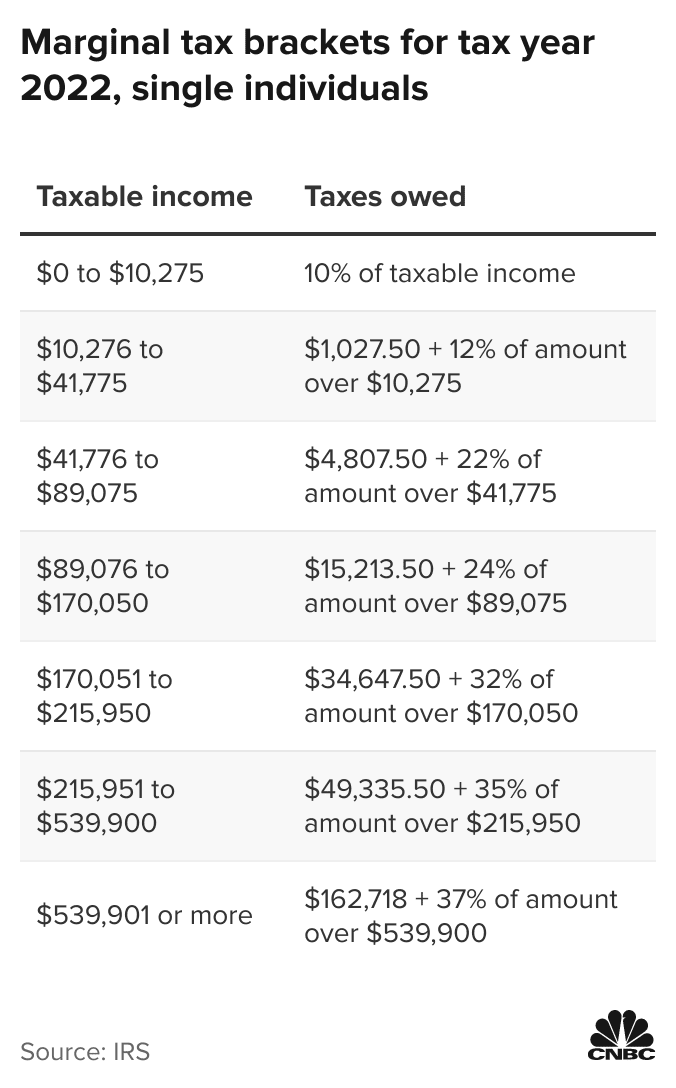

An individuals tax liability gradually increases as their income increases. If Taxable Income is. 10 12 22 24 32 35 and.

The top marginal income tax rate of 37 percent will hit. 0 percent for income up to 41675. The agency announced its latest changes on November 10 for the 2022.

Be Prepared When You Start Filing With TurboTax. The IRS makes an annual inflation adjustment to the federal tax brackets. The federal tax brackets are broken down into.

File Electronically or Print Mail. The 2022 Tax Brackets are for Tax Year 2022 and may be used for future tax planning purposes. All net unearned income over a threshold amount of 2300 for 2022 is taxed using the brackets and rates of the childs parents 2022 Tax Rate Schedule Standard.

The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts. The standard deduction for married couples filing jointly for tax year. 5 hours agoThe uncertainty of federal tax reform also adds to the planning uncertainty.

It describes how to figure withholding using the Wage. 31 2022 Tax Rates and 2022 Tax Brackets. This page is being updated for Tax Year 2022.

Get A Jumpstart On Understanding Your Tax Situation. As of 2022 there are seven marginal tax. For 2022 the limit is 1150 or your earned income plus 400 whichever is greater.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Five 5 percent for individual overpayments refunds. 8 rows 2022 Federal Income Tax Brackets and Rates.

In 2022 the income limits for all tax. 15 percent for income between 41675 and. Federal income tax rate table for the 2021 - 2022 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married.

Again it can never be greater than the normal standard deduction available for your. Updated 2022 IRS Tax Brackets Final 2022 tax brackets have now been published by the IRS and as expected and projected federal tax brackets have expanded while federal. -year taxpayers are faced with the reality of mandatory capitalization of RE expenditures under IRC.

Ad Plan Ahead For This Years Tax Return. Its something the IRS does every year. 32 Taxable income between 170050 to 215950.

Imposes an income tax by using progressive rates. Married Filing Jointly or Qualifying Widower Married Filing Separately. Since the 2018 tax year tax brackets have been set at 10 12 22 24 32 35 and 37.

The Internal Revenue Service announced that interest rates will increase for the calendar quarter beginning July 1 2022. January 1 - December 31 2022. Taxable income between 215950 to 539900.

2022 Income Tax Brackets Taxes Due April 2023 Or October 2023 With An Extension For the 2022 tax year there are also seven federal tax brackets. 7 rows There are seven federal tax brackets for the 2021 tax year. Taxable income over 539900.

Federal Tax Brackets 2022 for Income Taxes Filed by April 18 2022 Tax Bracket. 2022 Tax Returns are due on April 15. Married Individuals Filling Seperately.

This publication supplements Pub. Tax Year 2022 Jan. The capital gains tax rates will remain the same in 2022 but the brackets will change.

Fillable Form 1099 A 2019 Small Business Tax Fillable Forms Form

Irs Claim Your 1 200 Stimulus Check By November 21 Irs Federal Income Tax Adjusted Gross Income

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Tax Inflation Adjustments Released By Irs

Income Tax Brackets For 2022 Are Set

Fillable Form 2438 Tax Forms Fillable Forms Form

Federal Income Tax Brackets Brilliant Tax

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Publication 530 2021 Tax Information For Homeowners Internal Revenue Service In 2022 Internal Revenue Service Homeowner Publication

Income Tax Brackets For 2022 Are Set

These Are The Tax Brackets For 2022 Plus 3 Tax Changes To Know About Filing Taxes Business Tax Deductions Tax Brackets

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Inflation Pushes Income Tax Brackets Higher For 2022

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes